In today’s competitive insurance landscape, operational efficiency is essential. Independent agencies and brokers face growing pressure to manage increasing policy volumes, comply with complex regulations, and deliver fast, accurate service.

Yet much of an agency’s daily work remains manual. Tasks like reconciling payments or processing renewals consume time, increase the risk of errors, and slow growth.

Automation offers a practical solution. When implemented strategically, it can improve accuracy, productivity, and customer experience without disrupting existing systems.

Understand Why Automation Matters

Before considering which processes to automate, it is important to understand why automation is necessary for your agency today. Repetitive, manual tasks such as reconciling payments, processing renewals, or tracking cancellations take up significant staff time, slow client response, and increase error risk.

Ask yourself these questions to see why automation should be a priority:

If you have checked off most of the boxes, it is time to consider automating your workflows.

Reflecting on these questions helps agencies recognize the opportunity cost of inaction and the strategic importance of automation. This forms the foundational “why” that motivates change.

Here’s a practical roadmap on how your agency can begin its automation journey with confidence.

Define the Purpose Behind Automation

Every successful transformation begins with a clear purpose. Automation should never be implemented for its own sake. It must serve the agency’s broader business goals.

Agencies often begin by asking:

- Which processes create the most bottlenecks?

- Where do manual efforts lead to delays or errors?

- What improvements will deliver measurable results, such as faster turnaround, better accuracy, or improved service quality?

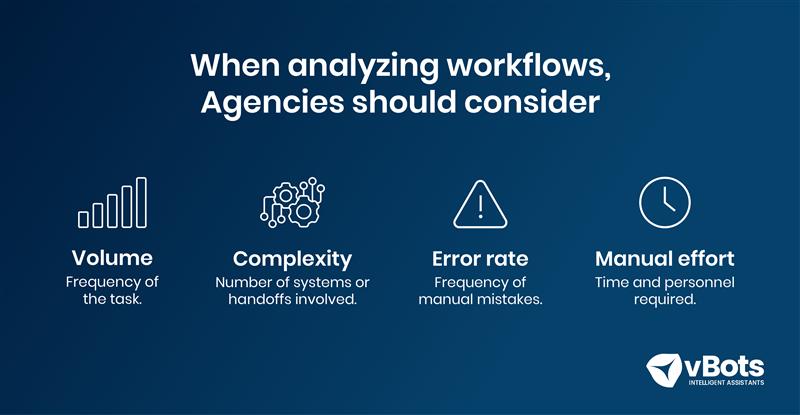

Map and Assess Existing Workflows

Before introducing automation, it is essential to understand how current processes function. Mapping workflows, from policy issuance to renewals and reconciliations, provides visibility into where time, effort, and resources are spent.

Processes that are repetitive, rule-based, and high in volume often deliver the greatest value when automated. This diagnostic step establishes the baseline for tracking improvements after deployment.

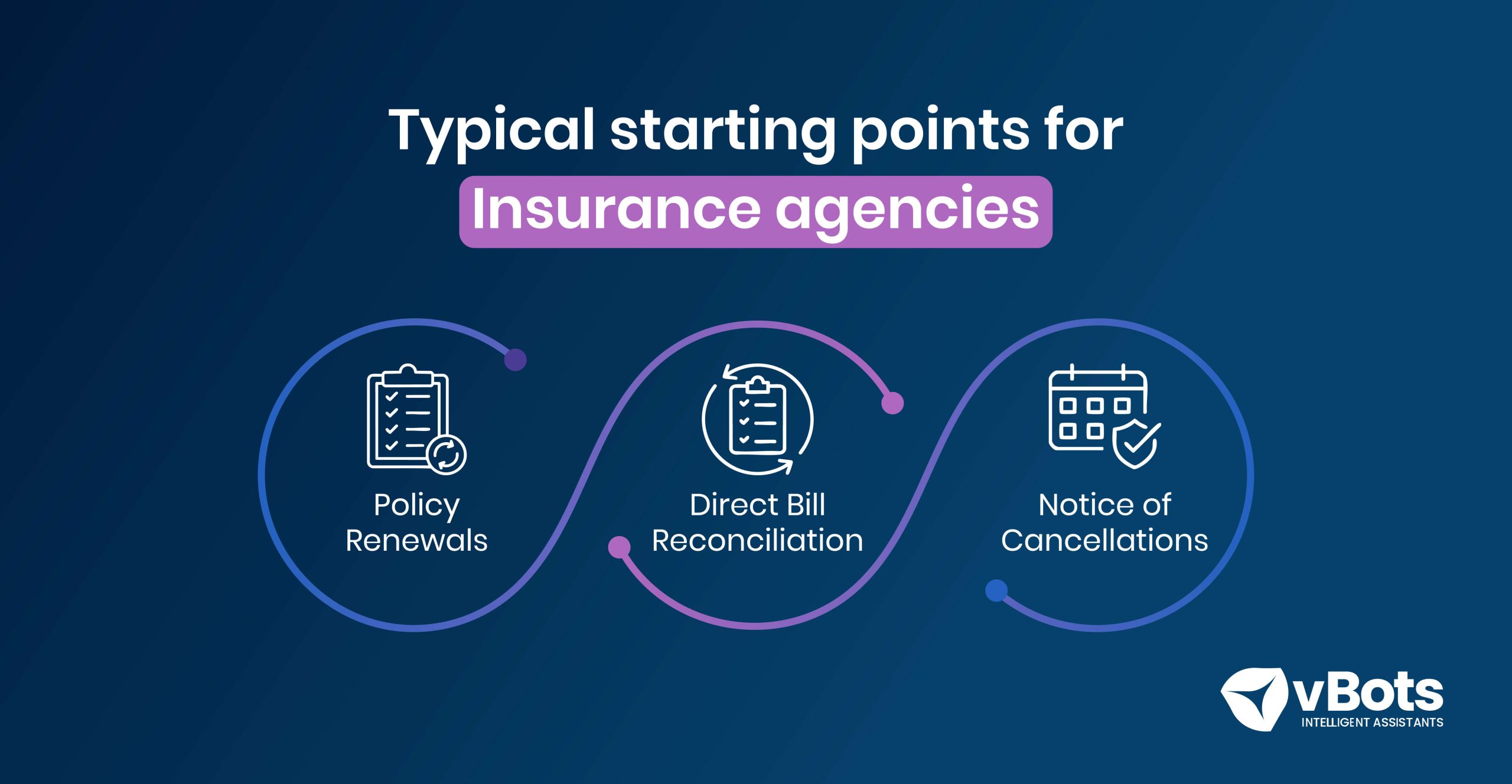

Identify High-Impact, Low-Complexity Opportunities

Automation delivers the best results when it starts small and scales steadily. The goal is to demonstrate success quickly, showing both efficiency gains and employee relief.

- Policy Renewals: Automatically retrieving renewal data and updating internal systems.

- Direct Bill Reconciliation: Matching carrier payments with agency records to save hours of manual review.

- Notice of Cancellations: Monitoring carrier portals, sending alerts, and updating records instantly.

Prepare and Engage the Team

For a deeper look at how to bring your team along on the automation journey, explore our guide on building trust within your agency when starting AMS automation.

Choose the Right Automation Partner

Insurance processes demand precision, security, and deep domain understanding. Selecting the right technology partner is critical.

When evaluating solutions, consider:

- Does the provider have proven experience with insurance operations and carrier workflows?

- Can their automation integrate seamlessly with your AMS, CRM, and policy management tools?

- How do they ensure compliance with data security and industry standards?

- Will they provide ongoing optimization after implementation?

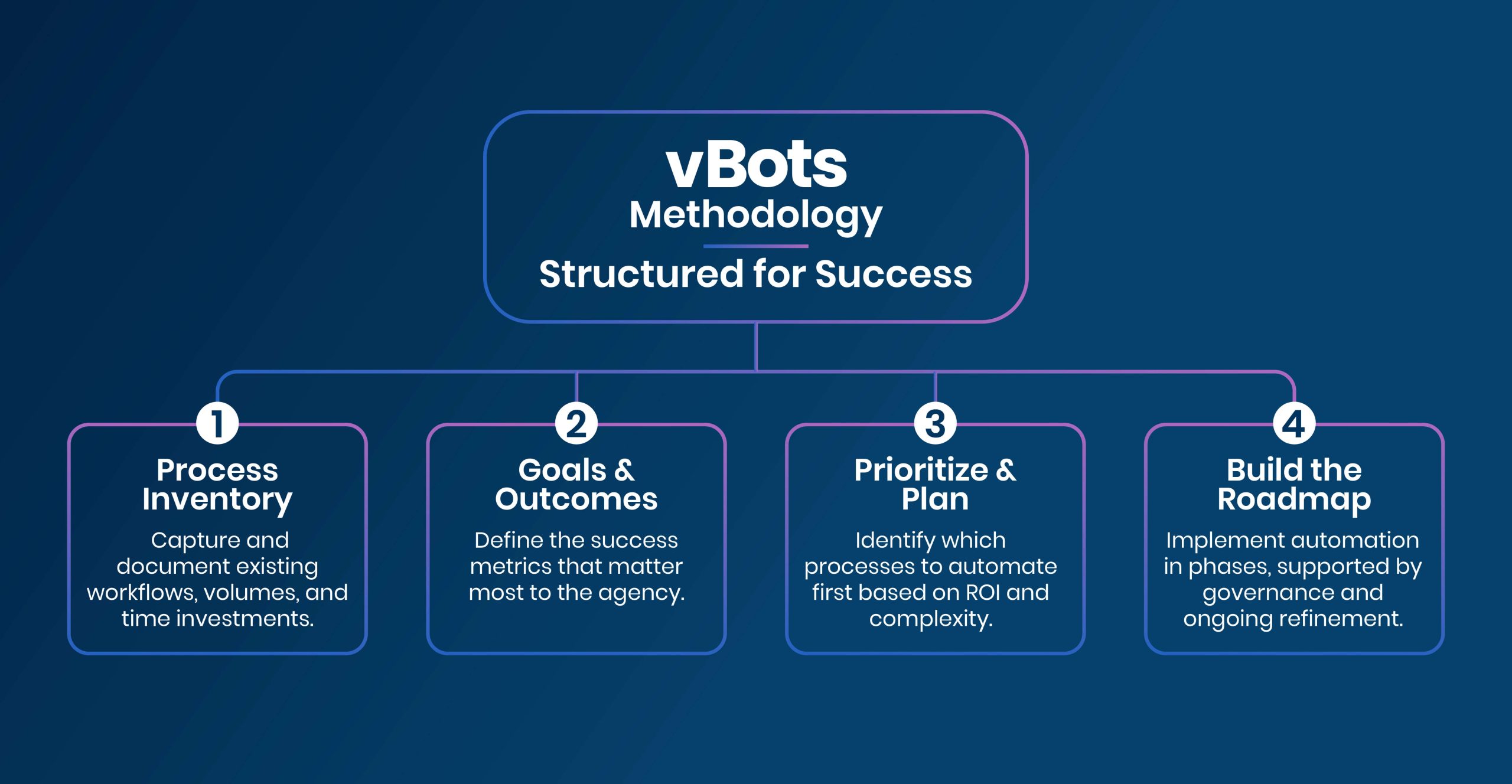

Develop a Scalable Roadmap

After initial success, agencies should approach expansion methodically. A structured roadmap ensures that automation continues to deliver value as adoption grows.

A scalable roadmap includes:

- Pilot insights: Reviewing early-stage outcomes and challenges.

- Next-phase priorities: Identifying adjacent workflows to automate.

- Governance: Defining roles, responsibilities, and success metrics.

- Continuous improvement: Refining workflows and performance over time.

How We Do It.

To help agencies transition from manual processes to intelligent, efficient operations, vBots follows a structured, outcome-based methodology:

This approach ensures agencies achieve measurable improvements in speed, accuracy, and scalability without compromising compliance or client trust.

Conclusion: Building Sustainable Efficiency

Start your automation readiness consultation with vBots.