Welcome to the insurance industry, a world defined by massive data management, rigorous validation processes, underwriting complexities, and stringent compliance standards. These processes, while essential, can often become repetitive, error-prone, and time-consuming. When manual workflows feel stuck on repeat, intelligent automation steps in to bring clarity and efficiency.

Intelligent Automation: Revolutionizing Insurance Workflows

Intelligent automation acts as a catalyst, enhancing the efficiency of insurance processes by automating routine tasks. It’s not merely automation—it’s intelligent automation driven by advanced AI, machine learning, and computer vision, designed to elevate your agency’s operational efficiency.

According to McKinsey, by 2025, intelligent automation will manage approximately 25% of tasks in the insurance industry, dramatically reshaping operations.

Automation Beyond the Buzz

Insurance agencies are rapidly integrating intelligent automation, reshaping their workflows across policy management, compliance, fraud detection, and more. It’s predicted that nearly 80% of insurance processes could soon leverage automation.

In terms of financial impact, intelligent assistants offer remarkable efficiency, recovering substantial employee hours. McKinsey notes that automation can save up to 34% of employee time spent on data processing alone, freeing teams to focus on high-value, strategic activities.

OCR & Intelligent Automation: The Perfect Alliance

Combining Optical Character Recognition (OCR) technology with intelligent automation eliminates data errors and streamlines document handling. A notable McKinsey study showed one insurance firm cutting onboarding costs by 91% and speeding processing times by an incredible 600% through automation.

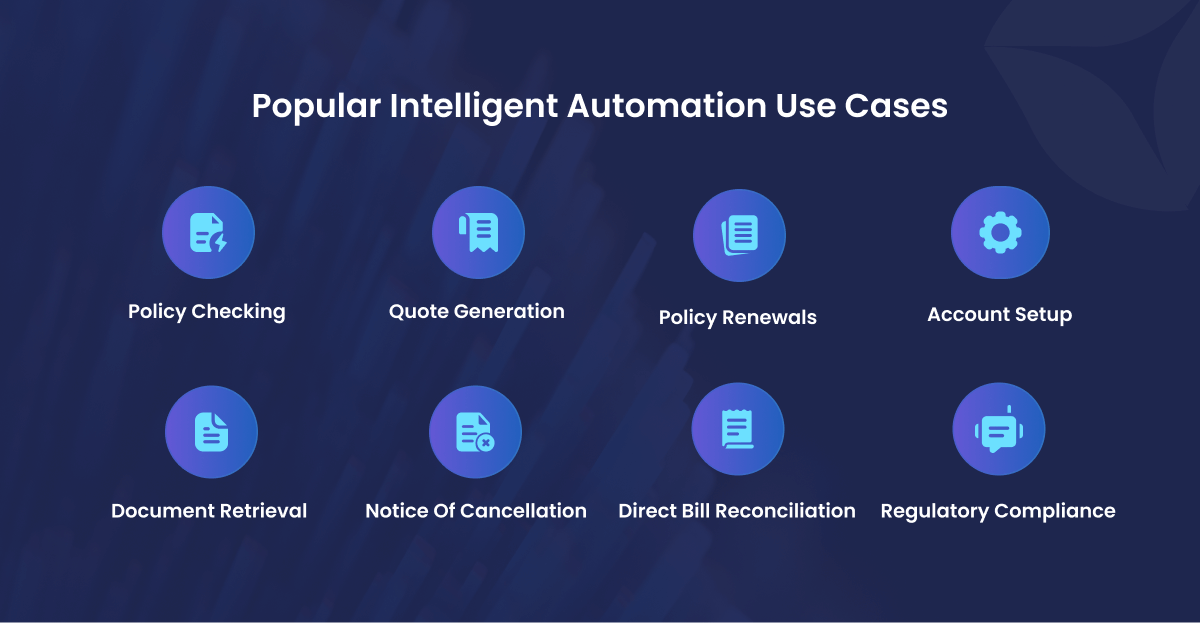

Intelligent Automation's Impactful Use Cases

Policy Checking

Manual policy comparison and validation often lead to errors, potentially creating costly coverage gaps. Intelligent assistants automate this critical process by instantly comparing current and prior policy terms, clearly highlighting changes. This ensures accurate, efficient, and comprehensive policy checks, significantly reducing manual oversight and the risk of missed discrepancies.

Quote Generation

Generating accurate insurance quotes manually involves significant data collection and complex risk assessments, making the process prone to errors and delays. Intelligent automation swiftly compiles relevant customer data, risk profiles, and historical insights, delivering rapid, precise, and reliable quotes. Agencies benefit from increased accuracy, faster customer service, and reduced workload.

Policy Renewal

Policy renewals are typically labor-intensive and susceptible to costly errors. Intelligent automation simplifies the renewal process by validating policies efficiently, ensuring timely notifications and accurate documentation, thus safeguarding both agency operations and client satisfaction.

Account Setup

Traditionally, setting up CSR24 accounts within systems like Applied Epic is a cumbersome, multi-step process. Intelligent automation simplifies this by automatically handling data entry, system integration, and account verification, significantly reducing setup times and the risk of manual entry errors.

Notice of Cancellation

Processing cancellation notices involves careful manual validation, prone to errors and delays. Intelligent assistants streamline this by automating validation, notification dispatch, and record-keeping. This ensures timely, error-free handling, crucial for compliance and customer relations.

Document Retrieval

Intelligent assistants swiftly retrieve, convert, and upload essential documents from carrier websites or email attachments into AMS platforms such as Applied Epic and AMS360. This eliminates manual searches, reduces errors, and substantially speeds up client service operations.

Direct Bill Commission Statement Reconciliation

Intelligent automation streamlines commission reconciliation by automatically extracting data from carrier statements, matching it to agency records, validating commissions, and flagging discrepancies. This ensures accurate financial reporting, reduced manual errors, and enhanced productivity.

Regulatory Compliance

Insurance compliance standards frequently change, making manual oversight risky. Intelligent assistants automate compliance checks, perform rigorous name screenings, and maintain comprehensive audit trails. Automation ensures compliance accuracy, reduces human error, and supports seamless regulatory audits.

Securing the Future with Intelligent Automation

According to Deloitte, investments in intelligent automation typically achieve ROI within 12 months. With AI-driven hyper-automation advancing rapidly, insurance processes continue becoming more sophisticated, efficient, and impactful. Now is the perfect moment to embrace intelligent automation, optimizing your operations and focusing your efforts where they matter most.

So, what are you waiting for? Talk to our automation experts today!